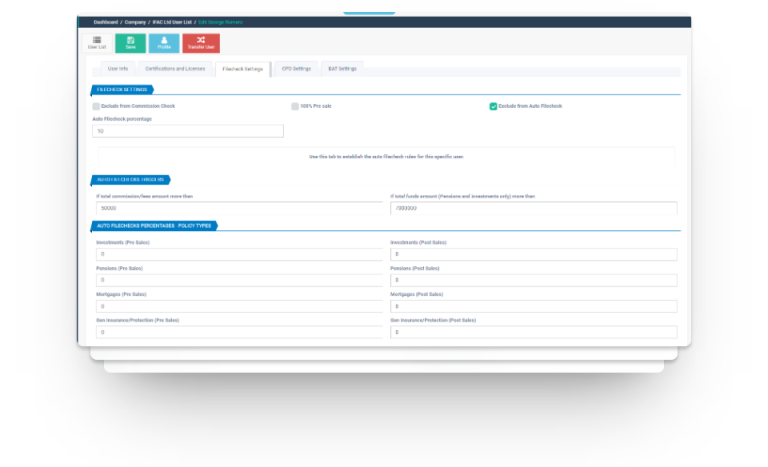

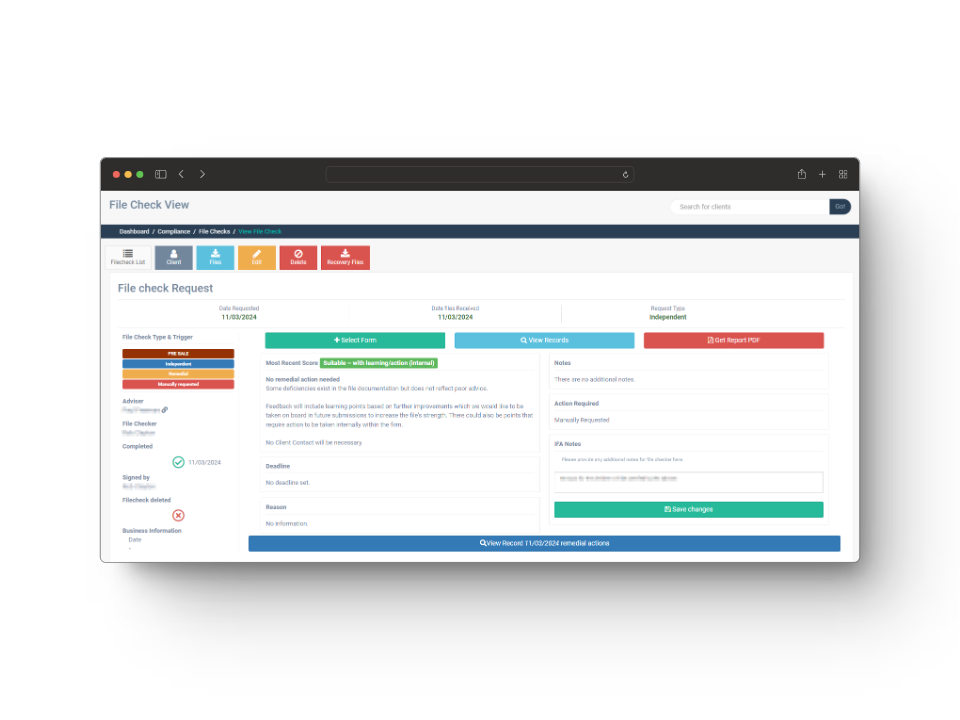

Provides capability to effectively file check all new business pre & post-sale and can be configured to target high risk cases, and process and track any remedial work needed through the system.

Get started now!

TRY BAT

FOR FREE

30 day free trial

No credit card required

FCA VIEW ON CHECKING

The FCA never tell anyone exactly what they want – but the IFA industry sets common standards that are quickly considered reasonable. Of course if your chosen standard can be accused of faling short, then it is only a short hop to being reckless, and that is a criminal offence under FSMA 2000.

Anything less than “reasonable” is a fail in the management of IFAs, mortgage brokers and protection sales staff.

The standard for IFAs, mortgage brokers and protection sales staff is for an average of 20% file checking across the board. Some business types and people will be classed as low risk and on much lower ratios – even down to one in 20, , but other bits of your busines will be on much higher ratios – for instance 100% file checks are usually applied for high risk business, (ad defined by you) and for advice in areas where the adviser is not signed off as CAS Competent Adviser Status, and for advice to the vulnerable customer, or for new advisers, who can never beassumed to be CAS status on entry, regardsless of experience and reference details. FCA expect every firm to sign off their advisers as CAS in each business area, and on an annual basis.

DELIVERING REPORTS

File checking the IFAs and mortgage broker compliance is in itself is all well and good, but not sufficient. You need to keep the records. It is not compliance with the rules that is the problem, but proving compliance with the rules. BAT delivers the holy grail, and enables you to show to counterparties, external compliance, FCA, FOS and product providers that you have the appropriate checks in place, and are monitoring advisers in line with the rules.

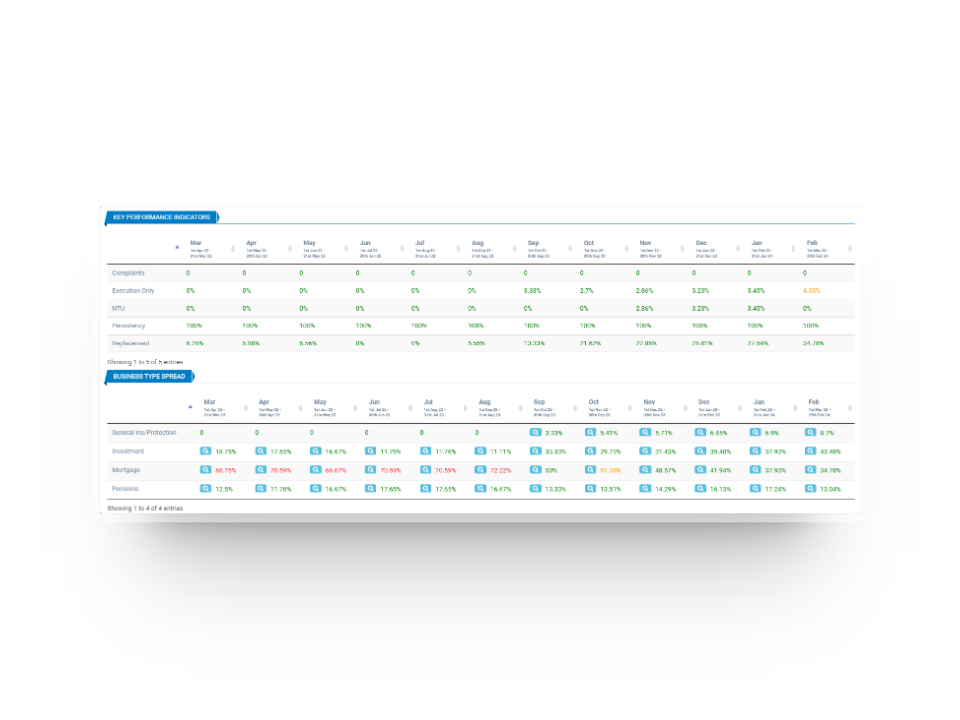

OUTPUTS, GRAPHS, KEY FEATURES AND KPIs

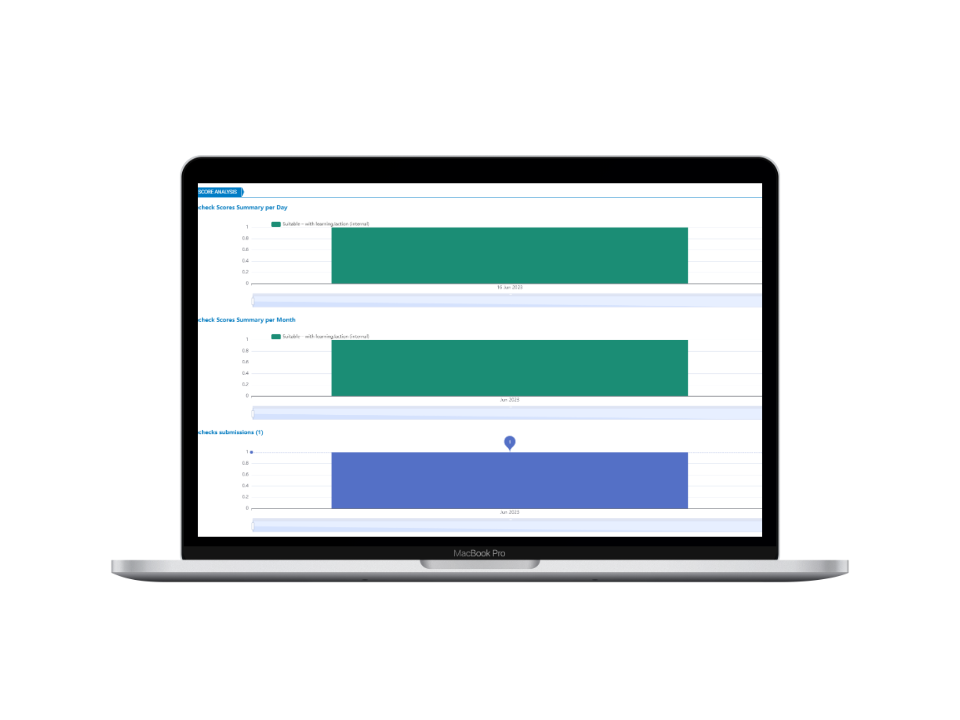

The FCA expect to see performance KPIs, and that includes tracking data, including graphs and pie charts that demonstrate that your management is on top of your IFAs and mortgage broker advisers, and your compliance director SMF16 is taking a proactive approach to compliance.

SUMMARY RESULTS AND TRAFFIC LIGHTS

FCA expect to see at the very least some sort of RAG rating, where RAG stands for Red, Amber Green. The traffic light system is an easy dashboard that BAT delivers to help you demonstrate to counterparties your active management of IFAs, mortgage brokers and protection sales staff. Your compliance director SMF16 needs BAT in order to reduce the baseline risk. Once you have secured the bottom line of risk, your business can set about making money and expanding. BAT file checking will make you money.

Book a Demo

Fill out the form to schedule a demonstration at your convenience.

This demo will showcase the key functionalities of BAT Compliance Manager and BAT CRM-PRO or CRM-Lite.

Additional Free Trial Available

24/7 Online Support

No credit card required