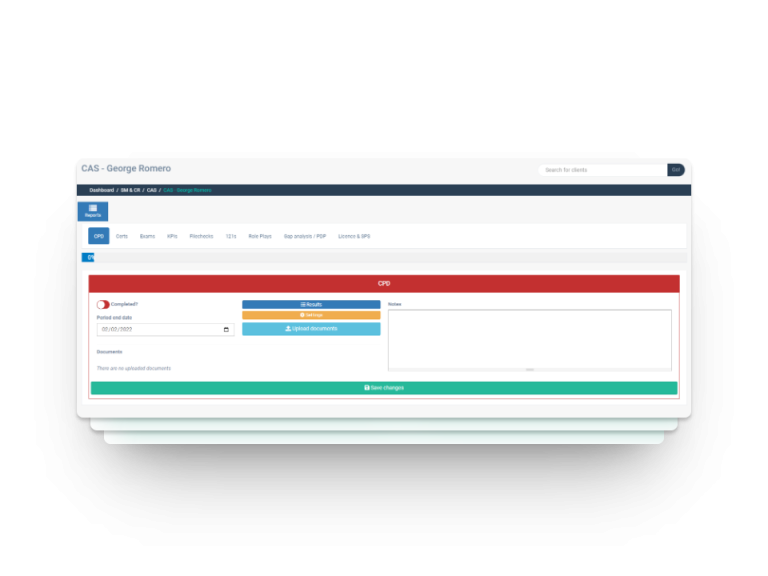

This will help you navigate the whole SM&CR process from onboarding new employees, through annual fit & proper checks to employees leaving the business. Create your very own exams and learning material or we can also provide questionnaires through our compliance partner IFAC

TRY BAT

FOR FREE

30 day free trial

No credit card required

SM&CR SOFTWARE

The BAT SMCR tool is unique in the market – no other firm has anything even close to what BAT provide.

SMCR means The Senior managers and Certification Regime as set out by the FCA here.

SM means Senior managers and that means you need FCA approval prior to appointing a senior manager to any SMF role.

CR means Certification regime and that means you need to send FCA notification prior to appointing a mortgage broker or IFA to a role. Protection advisers do not register with the FCA under SMCR but are subject to the same standards.

If you are going to send anything to the FCA, you need to get your ducks in a tidy row first.

BAT is a compliance management software tool that enables this for you.

This SMCR tool helps IFA and mortgage broker firms navigate either of the SM&CR processes from onboarding new employees, through to annual fit and proper checks, the annual anti-money laundering training and exams, and on to employees leaving the business. FCA expect you to set exams and learning material for IFAs and Mortgage brokers.

Inside BAT you can automatically tap into our workflow questionnaires and material as provided by IFAC to guide through your process

WATCH THE LAUNCH OF BAT SMCR HERE

CEO INTRODUCTION

Charlie palmer says: “I am CEO of BAT, and came up with the idea of the SM&CR tool when I saw advisers struggling to input FCA standards inside our sister company IFAC. When submitting any form for approval with the FCA, it often involves a simple tick to say “all done.” However if you tick that box, and the FCA ask for evidence and you are unable to provide it, then you risk being put on a charge of fraud by false representation. The FCA enforcement team will welcome you into their cuddly embrace.

IFAC asked BAT to produce a workflow for applying to the FCA for approval as a senior manager or director, and for certifing IFAs or mortgage brokers as compliant and competent.

Book a Demo

Fill out the form to schedule a demonstration at your convenience.

This demo will showcase the key functionalities of BAT Compliance Manager and BAT CRM-PRO or CRM-Lite.

Additional Free Trial Available

24/7 Online Support

No credit card required