The Woodford scandal has exposed the high number of unquoted holdings inside OEIC funds. This is a concern as the FTSE public markets continue to shrink, and with companies like Shell considering changing their listing to the USA, and Peel Hunt warning in April 24, that it could all be over in a decade for public shares in the UK, you have to wonder about the pricing of these unlisted shares, and the composition of the OEICs. Who values them on the balance sheet? Is it done with a clip board, as with commercial property?

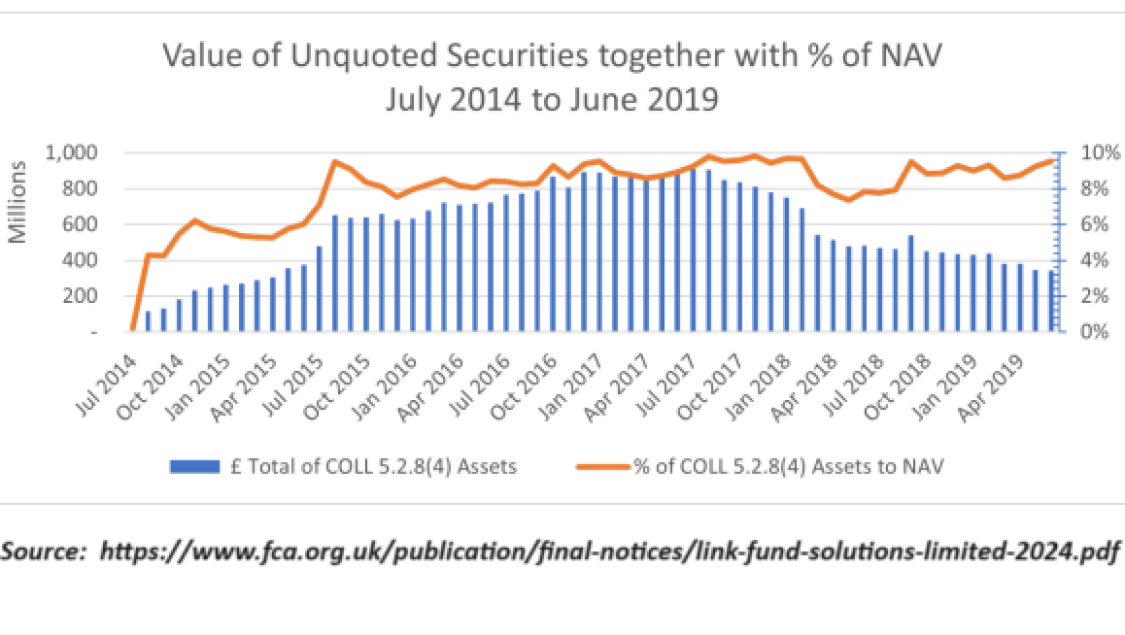

Values in the unlisted share markets are apparently sky high, with PE ratios twice those showing up on the FTSE All-Share, according to Martin Gilbert. But IFAs want to know about liquidity, and tracking individual funds is a critical piece. The value of Unquoted Securities that is permitted in a fund is 10% of its NAV, as set out in COLL. But if the value is unreliable in the first place – being unquoted – then we are all in the proverbial.

Another problem for IFAs came out of the scandal. All IFAs had find the Woodford related holdings in their client portfolios. What if you only recorded the Model Portfolio Service or held fund of funds or failed to record the in and out of that particular fund? BAT has this information all ready for you. Partly this comes from feeds from Transact, or, for other users, in CSV uploads into BAT. The vast majority enter new business portfolios using the drop down boxes of fund type (which is regularly updated). So for users of BAT, finding the Woodford holdings, the amounts invested, the values at closure and writing to the affected clients was a five minute task. Just as well, because the FCA wanted this information when the crisis blew up.

At BAT we believe in slow growth as the path to a great system. Hence we have no outside shareholders, and no venture capital injections. Organic growth. Between January and April 2024 we added 144 net users to BAT.