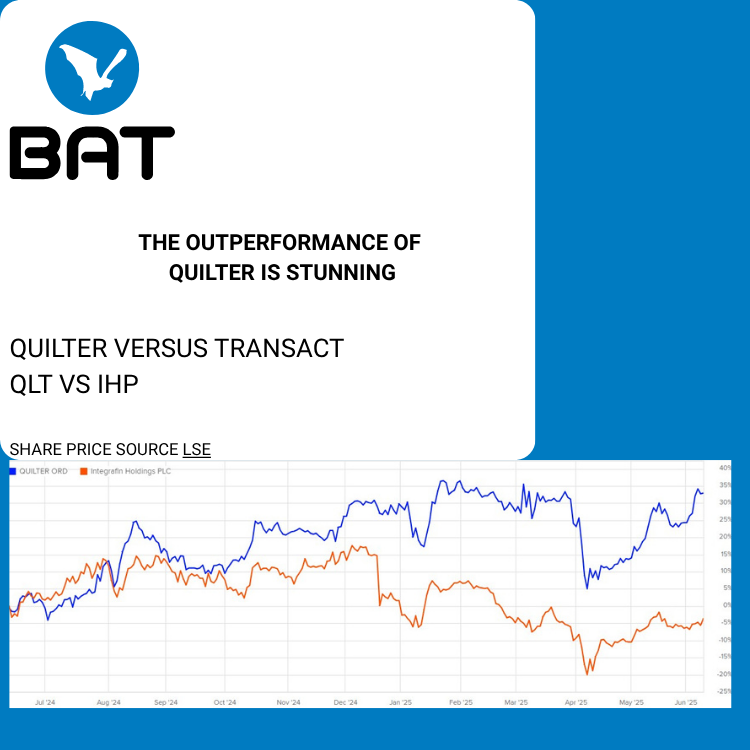

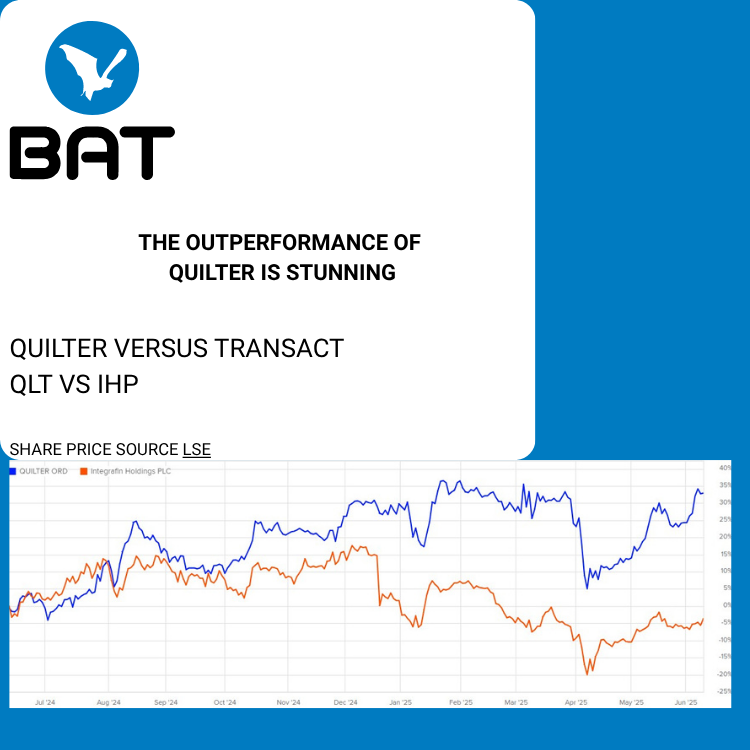

QUILTER – SHARE TIPS FOR WEALTH MANAGERS USING BAT

QUILTER – SHARE TIPS FOR WEALTH MANAGERS USING BAT

QUILTER – SHARE TIPS FOR WEALTH MANAGERS USING BAT

You may be looking for any number of new features in the new world. TIKTOK is a remarkable thing.And the frontier keeps expanding. Just like

The IFA advises, and creates a feel good factor for the customer.

R&D PRODUCTIVITY UNDER FCA RULES

BAT know what a well run firm looks like. Directors get involved in changing process. Automation is essential for business survival.

Financial advisers and mortgage brokers across the UK are preparing for heightened anti-money laundering (AML) compliance requirements following HM Treasury’s approval of revised guidance under the Money Laundering Regulations 2017, effective 23 April 2025.

With BAT’s YOTI integration, you are not just ticking regulatory boxes but rather establishing a sophisticated verification infrastructure that protects your business while streamlining client onboarding. Don’t just comply. Use BAT and verify!

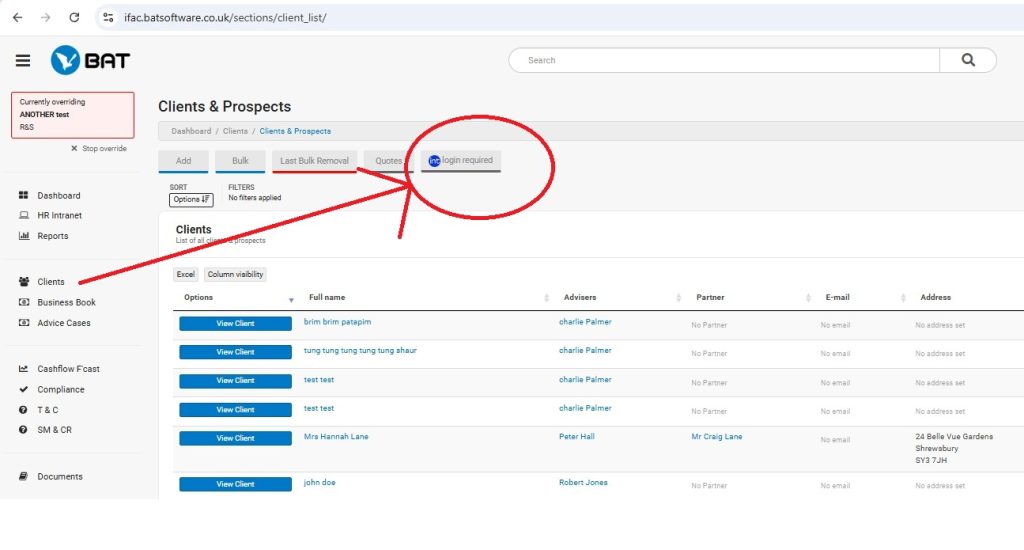

BAT have launched a tool to pull information from Intelliflo into BAT. The tool enables firms with data on Intelliflo to bulk transfer clients and

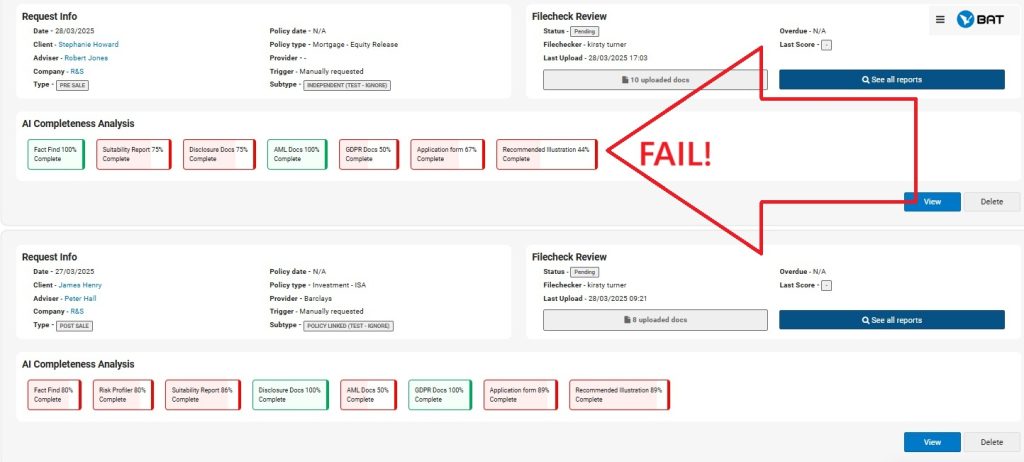

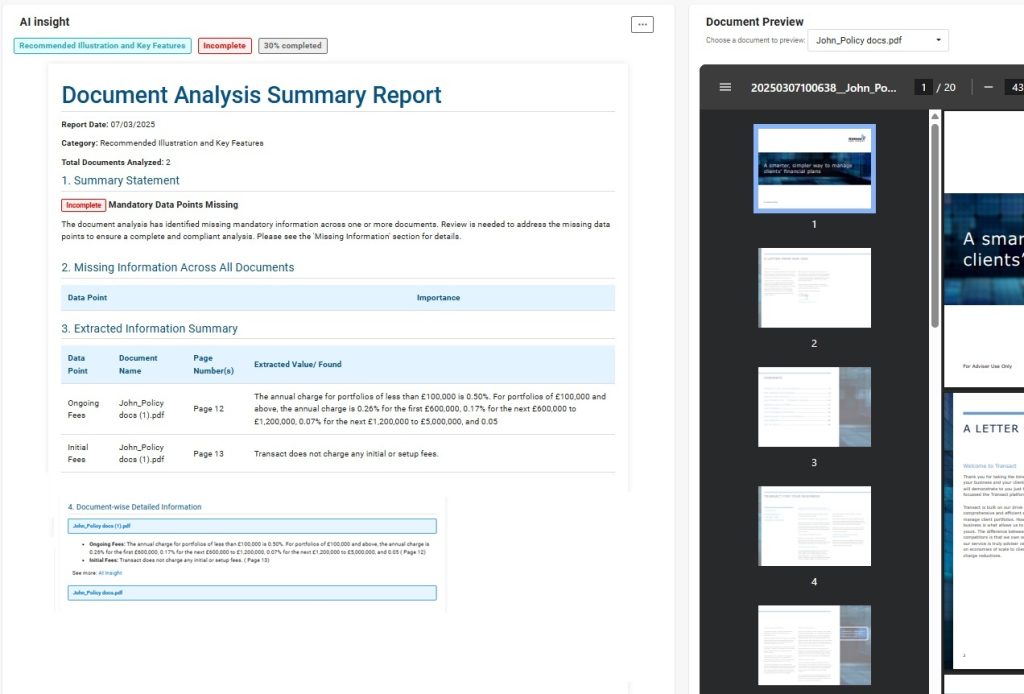

BAT Software, a UK-based leader in FinTech for the UK Advice market, is proud to announce the launch of the latest iteration of the AI File Checking tool: The BAT AI Advice/Suitability Checker.