DROWNED DOG MONTH

“The month of the drowned dog” so wrote Ted Hughes about November.BAT say it can be the best of times – the sort of cheery

“The month of the drowned dog” so wrote Ted Hughes about November.BAT say it can be the best of times – the sort of cheery

FCA issued Feedback Statement FS25/2 last monthhttps://content.govdelivery.com/accounts/UKFCA/bulletins/3c6b0be You must demonstrate how you’re embedding the Duty: governance, outcome-monitoring, data on vulnerable customers, product/service alignment. If you’re

Question: what is the most exciting thing to hit retail financial services since ETFs?

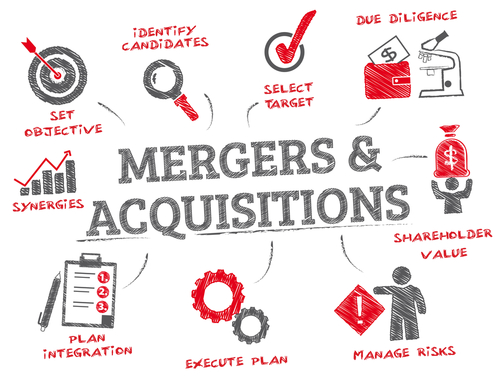

Why the FCA missed file checking in recent review of consolidation

Cashflow forecasting tools designed for financial services are dead